OUR UPDATES

NEWS

Aug 5, 2024

Why Fixing Up Your House Can Help It Sell Faster

By

Olivia Rodman

If you’re thinking about selling your house, you should know there are buyers who are ready and able to pay today’s high prices. But they want a home that’s move-in ready. A recent press release from Redfin explains:

“Buyers are still out there and they’re willing to pay today’s high prices, but only if the house is in really good shape. They don’t want to spend extra money on paint or new appliances.”

It makes sense when you think about it. They’re having to pay a lot of money for a house in today’s market. That means they may not be able to easily afford upgrades after they move in. So, if your home is outdated or needs some work, buyers might pass it by or offer a lower price than you were hoping for.

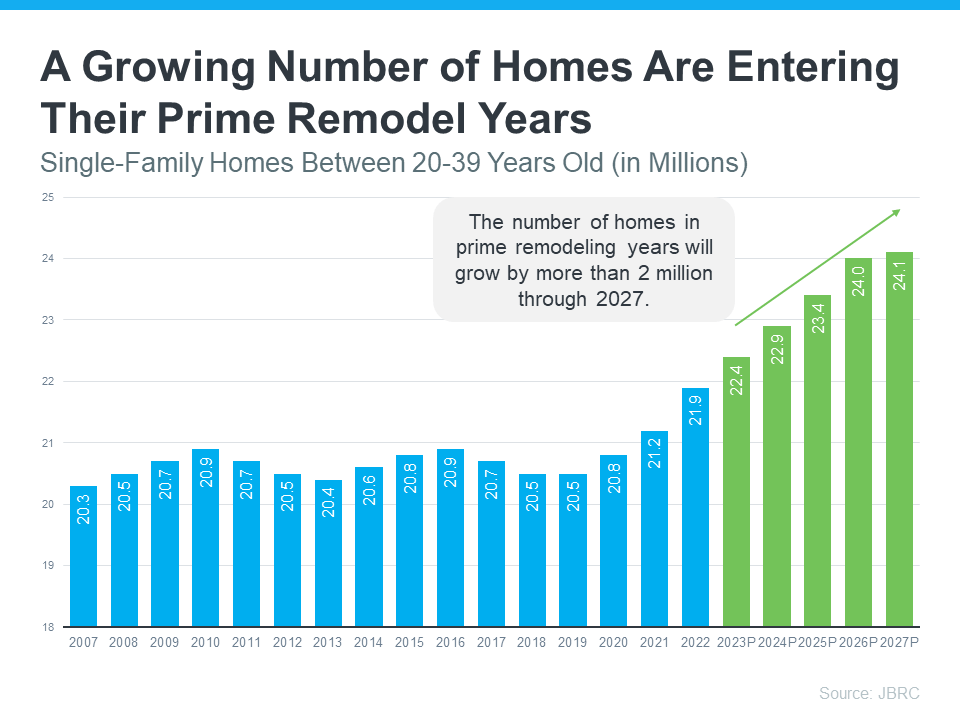

And there are a lot of homes that need upgrades right now. Millions are entering their prime remodel years, meaning they’re between 20 and 39 years old. Maybe yours is one of them. According to John Burns Research and Consulting (JBRC), the number of homes in their prime remodel years is high and growing (see graph below):

If your house falls into this category, it's important to consider making selective updates to help it appeal to buyers, so it sells faster. But how do you know where to spend your time and money?

Why You Need a Real Estate Agent

By working with a local real estate agent to be strategic about the improvements you make, you can be sure you’re making a smart investment. Put simply, not all upgrades are worth the cost. As Bankrate says:

“Before you spend money on costly upgrades, be sure the changes you make will have a high return on investment. It doesn’t make sense to install new granite countertops, for example, if you only stand to break even on them, or even lose money.”

And, as that same Bankrate article goes on to say, that’s where a local real estate agent comes in:

“. . . a good real estate agent will know what local buyers expect and can help you decide what needs doing and what doesn’t.”

Your agent will know what buyers in your area are looking for and what they're willing to pay for it. By working together, you can avoid spending money on upgrades that won't pay off. Instead, they’ll fill you in on which changes will make your house more appealing and valuable.

Bottom Line

Selling a house right now requires more than just putting up a For Sale sign. You need to make sure it’s in good condition to attract buyers who are willing to pay today’s high prices.

The way to do that is by making smart improvements that will give you the best return on your investment. Let’s work together so you know what buyers are looking for and what your house needs before selling.

Jul 7, 2024

How Long Will It Take To Sell My House?

By

Olivia Rodman

You want your house to sell fast. And you may be wondering how long the whole process is going to take. One way to get your answer? Work with a local real estate agent. We have the expertise to tell you how quickly homes are selling in your area and what’s impacting timelines for other sellers. That way you have realistic expectations and can work together to come up with a plan that’s based on today’s market.

Here’s a high-level overview of just one of the factors a great agent will walk you through – the supply of homes for sale and how that impacts your process.

The Growing Supply of Homes for Sale

Over the past few months, the number of homes for sale has increased. This is good news when you move because it means you’ll have more options as you search for your next home. But it also means buyers have more to choose from, so if your house doesn’t stand out – it may take a bit longer to sell.

Think of the homes on the market like loaves of bread for sale in a bakery. When a fresh batch of bread is put out, everyone wants the newest and hottest one. But if a loaf sits there too long, it starts to get stale, and fewer people want to buy it. The same goes for homes. New listings are the freshest and most sought-after. But if a home isn’t priced correctly, doesn’t show well, or it doesn’t have an effective sales or marketing strategy behind it, it can sit on the market and become less appealing to buyers over time.

An Agent Will Help Your House Stand Out and Sell Quickly

Timing is important to you. You want to get this done, fast. By leaning on a pro, they’ll make sure your listing is fresh and doesn’t stick around long enough to go stale. As the National Association of Realtors (NAR) explains:

“Home sellers without an agent are nearly twice as likely to say they didn’t accept an offer for at least three months; 53% of sellers who used an agent say they accepted an offer within a month of listing their home.”

Your agent will factor the recent inventory growth into their plan and create a customized selling strategy for your house. The supply of homes for sale can vary a lot by area. So they’ll do things like share their valuable insights into what’s happening with supply in your market, help you price your home correctly, and create a marketing plan that gets your home noticed.

Don’t let your listing get stale—reach out to a real estate agent today to make sure your listing is fresh and appeals to buyers from the start. It makes a big difference.

Bottom Line

If you want your house to sell fast, you need to work with a pro. Connect with a local agent, so you’ve got someone who understands the current market trends and how to build a strategy around those factors, so your house is set up to sell quickly.

May 14, 2024

A Beginner's Guide To Investing In Commercial Real Estate

By

Olivia Rodman

Commercial real estate (CRE) investing is quite different from the stock market. However, similar strategies and risks still apply. Many investors like the appeal of CRE because it has the potential to generate higher returns and offers added tax benefits.

However, if you're interested in this type of investing, there are some things to know. Based on my experience as an investor, the following information should serve as a beginner's guide to investing in commercial real estate.

How To Start In Commercial Real Estate Investing

Before deciding that CRE investing is right for you, there are a few questions you should ask yourself. The first of these questions is whether you should invest in a single property, a REIT or a crowdfunding option.

With this, it's vital to understand that when considering a crowdfunding group, you must check out the firm's track record before investing. Be sure to learn their obligations and rights when it comes to withdrawing funds.

In regards to single commercial properties, I recommend that you identify the key characteristics that detract from or improve the trends or attractiveness of the property. Most professionals in the commercial real estate industry got their start with single-family rentals. This is helpful because though the investment is not the same, residential real estate gives you a good foundation for starting in CRE.

Rewards And Risks Associated With CRE Investing

Regardless of your investment type, each comes with its own associated risks. Commercial real estate is not an exception. Though the economy is trying to enter recovery mode, in many ways, the Covid-19 pandemic affected commercial real estate more than others over the past few years.

For example, vacancy levels sharply rose for some properties like office space, apartments and retail, while data centers and industrial properties performed well. However, most experts agree that long-term contractual leases are helpful with commercial real estate. In other words, if a commercial property is under a long-term contractual lease, there's less worry about near-term market exposures, and it can help protect investors from economic volatility.

One benefit is that the value of real estate tends to depreciate over time, so a tax code allows commercial property owners to depreciate a property's value in return for an annual deduction on income taxes. This system provides property owners and investors to also be compensated for renovations aimed at addressing maintenance concerns.

This depreciation allows an owner to hold more of their money by not spending it on taxes. Nonresidential properties allow for 39 years' worth of depreciation, which can add up to a significant amount that's saved on your taxes.

Another reward offered by CRE investing is the 1031 exchange. This is a tax instrument that allows the investor to defer capital gains. The IRS requires you to pay capital gains tax when an investment is sold. However, using the 1031 exchange, commercial real estate investors can hold off on this so they can hold more capital to buy another property.

Should You Invest In Commercial Real Estate?

Ultimately, the decision to invest in commercial real estate will depend on your overall goals. Some people prefer to stick with single-family homes and never enter the CRE market. However, those who do decide to take the leap often find higher returns, greater tax benefits and instant portfolio diversification. Perhaps the best part is you have options, so I urge you to take a closer look at direct and indirect commercial real estate investing and decide which type best aligns with your goals.

The information provided here is not investment, tax or financial advice. You should consult with a licensed professional for advice concerning your specific situation.

Apr 30, 2024

5 Things to Keep in Mind When Buying a New Home

By

Olivia Rodman

Budget: Determine how much you can afford to spend on a new home, including considering additional costs such as property taxes, maintenance, and utilities. Stick to your budget to avoid financial strain in the future.

Location: Choose a location that fits your lifestyle and needs, such as proximity to work, schools, shopping centers, and recreational activities. Consider factors like safety, neighborhood amenities, and future development plans.

Size and layout: Consider the size of the home and the layout that best suits your family's needs. Think about the number of bedrooms and bathrooms, as well as any specific features or amenities you desire, such as a backyard, garage, or open floor plan.

Condition of the property: Inspect the property thoroughly to ensure it is in good condition and free from major issues that could require costly repairs. Consider hiring a professional home inspector to identify any potential problems before making an offer.

Resale value: Think about the potential resale value of the home in the future. Consider factors such as the local real estate market, neighborhood trends, and any planned developments that could affect the value of the property. Choose a home that has the potential to appreciate in value over time.